Are you planning to use your Navy Federal Credit Card abroad and wondering about the associated foreign transaction fees? If so, you’re not alone. Many Navy Federal Credit Union members are curious about how these fees work and how they can minimize costs while traveling internationally. In this article, we will break down everything you need to know about Navy Federal Credit Card foreign transaction fees, offering practical tips and expert advice to help you make informed decisions.

Navy Federal Credit Union is one of the largest credit unions in the United States, serving millions of members, including military personnel, veterans, and their families. As part of their financial services, they offer a variety of credit cards with different benefits and features. However, understanding the fees associated with international transactions is crucial for anyone who plans to use their Navy Federal Credit Card abroad.

This guide aims to provide clarity on Navy Federal Credit Card foreign transaction fees, ensuring that you are well-prepared for your next international trip. Whether you're a frequent traveler or planning your first overseas adventure, this article will equip you with the knowledge you need to manage your finances effectively.

Read also:Mckinley Ofleaks The Definitive Guide To Understanding The Phenomenon

Table of Contents:

- Biography of Navy Federal Credit Union

- Overview of Navy Federal Credit Cards

- Foreign Transaction Fees Explained

- Types of Navy Federal Credit Cards

- Comparison of Foreign Transaction Fees

- Tips for Avoiding Foreign Transaction Fees

- Benefits of Navy Federal Credit Cards

- Travel-Specific Features

- Common Questions About Foreign Transaction Fees

- Conclusion and Call to Action

Biography of Navy Federal Credit Union

History and Background

Navy Federal Credit Union was established in 1933 and has since grown to become one of the largest credit unions in the world. It serves over 11 million members and offers a wide range of financial products and services, including savings accounts, loans, and credit cards. Its mission is to provide quality financial services to the military community, ensuring that members have access to affordable and reliable financial solutions.

Key Milestones

Over the years, Navy Federal Credit Union has achieved several milestones that have solidified its reputation as a trusted financial institution:

- 1933: Founded with just seven members.

- 1970s: Expanded membership eligibility to include all branches of the military.

- 2000s: Introduced digital banking services to enhance member convenience.

- 2020: Celebrated over $100 billion in assets under management.

Contact Information

For more information about Navy Federal Credit Union, you can visit their official website or contact them directly. Their headquarters is located in Vienna, Virginia, and they have branches across the United States.

Overview of Navy Federal Credit Cards

Navy Federal Credit Union offers a variety of credit cards tailored to meet the needs of different members. These cards come with competitive interest rates, rewards programs, and additional benefits. However, it's important to understand the fees associated with these cards, especially if you plan to use them internationally.

Foreign Transaction Fees Explained

What Are Foreign Transaction Fees?

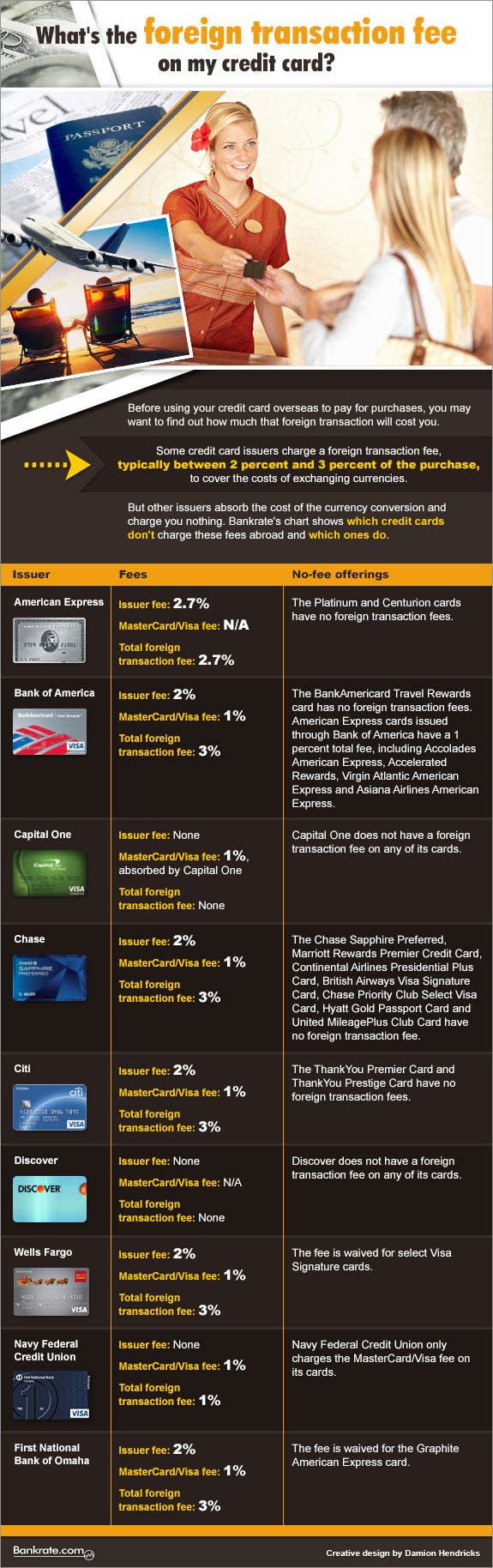

A foreign transaction fee is a charge applied by credit card issuers when you make purchases in a foreign currency. This fee is typically a percentage of the transaction amount and is designed to cover the costs associated with currency conversion.

Read also:Cindy Clerico The Rising Star In The Spotlight

How Do Foreign Transaction Fees Work?

When you use your Navy Federal Credit Card abroad, the transaction is processed in the local currency and then converted to USD. The foreign transaction fee is applied during this conversion process. For example, if you make a purchase of $100 and the foreign transaction fee is 1%, you will be charged an additional $1 for the transaction.

Types of Navy Federal Credit Cards

Platinum Card

The Navy Federal Platinum Card offers a low foreign transaction fee of 1%. It also provides cashback rewards and a competitive APR, making it a popular choice for members who travel frequently.

Visa Signature Card

The Visa Signature Card from Navy Federal Credit Union comes with a slightly higher foreign transaction fee of 2%. However, it offers additional perks such as travel insurance and concierge services, which may offset the cost for some users.

Comparison of Foreign Transaction Fees

When comparing Navy Federal Credit Cards with other financial institutions, it's important to consider the foreign transaction fees. Below is a table summarizing the fees for various Navy Federal Credit Cards:

| Credit Card Type | Foreign Transaction Fee |

|---|---|

| Platinum Card | 1% |

| Visa Signature Card | 2% |

| Classic Card | 1% |

Tips for Avoiding Foreign Transaction Fees

Use a Card with No Foreign Transaction Fee

If you're concerned about foreign transaction fees, consider applying for a credit card that doesn't charge them. Some Navy Federal Credit Cards offer this benefit, so be sure to check the terms and conditions before making a decision.

Pay in USD Whenever Possible

When making purchases abroad, always opt to pay in USD if given the option. This can help you avoid unnecessary currency conversion fees and ensure that your transaction is processed at a fair exchange rate.

Benefits of Navy Federal Credit Cards

Competitive Interest Rates

Navy Federal Credit Union offers some of the lowest interest rates in the industry, making it easier for members to manage their debt and build credit.

Rewards Programs

Many Navy Federal Credit Cards come with cashback rewards or points that can be redeemed for travel, merchandise, or statement credits. These programs provide additional value to members who use their cards responsibly.

Travel-Specific Features

Travel Insurance

Some Navy Federal Credit Cards offer travel insurance, which can provide peace of mind when traveling abroad. This coverage may include trip cancellation, lost luggage, and emergency medical assistance.

Concierge Services

For members who travel frequently, the concierge services offered by Navy Federal Credit Union can be a valuable resource. These services can assist with booking flights, hotels, and other travel arrangements.

Common Questions About Foreign Transaction Fees

Are Foreign Transaction Fees Avoidable?

Yes, foreign transaction fees can be avoided by using a credit card that doesn't charge them. Additionally, paying in USD whenever possible can help minimize costs.

How Are Foreign Transaction Fees Calculated?

Foreign transaction fees are typically calculated as a percentage of the transaction amount. For example, a 1% fee on a $100 purchase would result in an additional charge of $1.

Conclusion and Call to Action

In conclusion, understanding Navy Federal Credit Card foreign transaction fees is essential for anyone who plans to use their card internationally. By selecting the right credit card and following the tips outlined in this article, you can minimize costs and enjoy a stress-free travel experience.

We encourage you to leave a comment below sharing your experiences with Navy Federal Credit Cards and foreign transaction fees. Additionally, feel free to explore other articles on our website for more valuable insights into personal finance and travel.

References: